Economic Development

The City of Brockton’s Economic Development Mission is to raise the City’s position within the larger Greater Metro Boston economic sphere by leveraging our competitive advantages that include an inventory of buildings and properties that are competitively priced within an increasingly expensive region and our excellent transportation assets.

Brockton Economic Development Overview

A Gateway City within easy reach of Boston and Providence, Brockton is uniquely situated within the region for businesses that want access to either metropolitan area as well as New England as a whole. It offers unparalleled access to markets and transportation corridors, and has established partnerships at the local, state, and federal level to bring economic development resources within easy reach of investors, whether they are native or new to the City.

With a large and diverse workforce that can easily access Boston or Providence, plus established commercial clusters that include food production, life sciences, electronics, healthcare, residential development, and minority-owned and small businesses, Brockton is the ideal location for doing business in the metro area. The Department of Planning and Economic Development is ready to help you get established in our City.

Brockton MA City of Champions app

As municipalities develop strategies for business recovery and resiliency amid the COVID-19 pandemic, the City of Brockton has collaborated with Old Colony Planning Council, and with grant funding from the MA Office of Business Development and developed a new mobile app for the “City of Champions.” The mobile app is the first technological tool under Mayor Robert Sullivan’s “Open For Business Initiative.”

The app is now available for download on the apple and android app stores.

Apple: https://apps.apple.com/us/app/

Android: https://play.google.

The “Brockton MA City of Champions” app will assist Brockton businesses by providing residents and visitors with an accurate business directory right at their fingertips. Businesses in the city are encouraged to claim their business on the app and upload website information, digital menus, special deals/discounts, etc. Currently, there is a list of over 2,000 businesses, many of which are still waiting to be claimed by business owners. Businesses can claim their business by visiting and following six easy steps on claim.mycivicapps.com (instructions for claiming business in multiple languages below).

Instructions for Claiming Your Business

Instruson pa Rekizita bu Negosiu

Instritions pou reklame biznis ou

Instrucciones para Hacerse Cargo de su Negocio en el app

For more background information regarding the app, please read the press release

Downtown Urban Renewal District

As the commercial and residential revival of Brockton’s historic downtown continues, the Urban Renewal District is one of the economic development tools the City has made available to investors. A part of the Brockton Downtown Action Strategy, created with support from MassDevelopment, the district includes incentives and financing options for new construction and renovation of existing sites.

Trout Brook Urban Renewal District

The City of Brockton is in the planning stages for a new industrial park that hosts the terminal to a 100 gigabyte fiber optic cable. With its on-ramp to the ultra-high-capacity line, the 66-acre site on Mass. Rte. 28 is ideally situated for a data center or back-office operations for regional corporations. It is also served by Brockton’s best-in-class public water and sewer utilities, and its electrical supply is double-fed by National Grid. The site, which is part of an Urban Renewal District, will be the first purpose-built industrial park in the City.

Federal Opportunity Zones

There are four federal Opportunity Zones in Brockton, each of which is designed to maximize investment opportunities. Two are located downtown – at the former CSX site, and in the Transit-Oriented Development (TOD) area that encompasses all area within one-quarter mile of the Campello and Montello Commuter Rail stations and within one-half mile of downtown; one is the 65-acre Brockton Fairgrounds on Mass. 123, the largest undeveloped site in the city; and one around Good Samaritan Medical Center, part of the Route 24 life sciences cluster. Special federal tax benefits are available to qualifying developments in these zones.

Brockton Permitting Handbook

Most development projects require a number of permits, approvals and licenses. This guidebook will explain for you the various staff persons, departments and boards involved with the development process for commercial and industrial development in the City of Brockton. It provides you with tips and suggestions so that your project can be efficiently reviewed by the appropriate City of Brockton staff and/or boards or commissions.

Brockton Investor Prospectus

Whether you are looking to take advantage of the Federal Opportunity Zones, our abundant water and sewer capacity, or our location just 20 miles south of Boston and Logan International Airport, the Brockton Investor Prospectus lays out a compelling argument for choosing Brockton for your business start up, expansion or relocation.

A copy of the Brockton Investor Prospectus is available here.

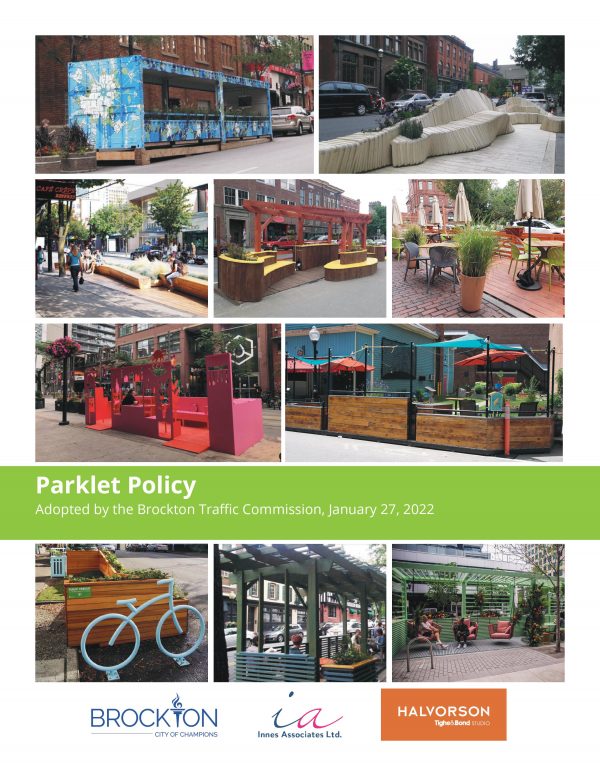

Downtown Parklet Program and Policy

The City of Brockton is dedicated to making our downtown a more welcoming and vibrant location, a place where residents and businesses alike can benefit from shared community spaces. Outdoor dining, public art, plantings, and other activities serve to add vitality and a sense of activity to the street. We encourage business owners, non-profit or community organizations to apply through the Department of Planning and Economic Development with professional plans and community support to activate the streetscape near you. Applications will be verified for consistency and applicability by the Department of Planning and Economic Development, then sent to the Traffic Commission for final review and approval or denial.

Economic Development Resources

The City of Brockton is dedicated to working with its native businesses, newcomers, developers, residents, and other stakeholders to improve city’s economy for everyone. At the Department of Planning and Economic Development, it is our job to help you find the incentives and tax credits you need to make your project a success.

We have worked extensively with both state and federal programs. Our staff understands how to navigate the landscape of grants, incentives, and tax credits to identify the ones that are most applicable to your project, and has the experience to guide you through the application and qualification processes.

City of Brockton

Downtown Building Activation Initiative (rent rebate).

The City will provide rent rebates, for up to two years, to approved tenants who lease currently vacant property in downtown Brockton. Tenants leasing vacant ground floor space could be eligible for a 50% rebate of their rent, up to $5,000 in the first year and 25%, (Max $2,500) in the second year. Tenants who lease upper floor space would be eligible for a 25% rebate up to $2,500 for two years. Tenants must be new to downtown and not relocating from an existing downtown location. Tenants wishing to occupy ground floor space must be either retail, restaurant or high pedestrian volume businesses to qualify for this program. Marijuana establishments are not applicable.

Brockton Redevelopment Authority

Brockton Downtown Restaurant Infrastructure Fund (BDRI)

Established as a local funding mechanism to incentivize new full-service restaurants in historic downtown Brockton, the fund received capital from the federal Department of Housing and Urban Development and provides loans of up to $350,000 to qualified borrowers.

Storefront Façade Improvement Program

Qualified applicants can receive an interest-free loan to be used for the renovation or restoration of commercial property in eligible Brockton locations. The funds can be applied toward architectural details, installation of energy-efficient windows and entrances, certain signage and awnings, and other improvement projects.

Commonwealth of Massachusetts

Massachusetts Housing Development Incentive Program (HDIP)

As a Gateway City, Brockton can offer this tool to developers who want to bring in new construction of market-rate residential projects or rehabilitate existing multi-unit residential housing. Through HDIP, Brockton can help developers of qualified projects apply for state tax credits and full or partial exemptions from local-option real estate taxes.

Massachusetts Brownfield Tax Credits (BTC)

Working with the Massachusetts Department of Environmental Protection, Brockton can help individuals, corporations, and nonprofit organizations apply for tax credits equal to as much as 50% of the cost of cleaning up contaminated property in the city.

Massachusetts Economic Development Incentive Program (EDIP)

A job-creation incentive program offered in collaboration with the state Economic Assistance Coordinating Council, Massachusetts EDIP provides employers with tax credits for bringing new employment opportunities to Brockton.

Massachusetts Vacant Storefront Program (MVSP)

To encourage reinvestment in Brockton’s historic downtown core, the state has certified the neighborhood’s eligibility for this competitive tax incentive program. The Massachusetts MVSP can provide refundable Economic Development Incentive Program tax credits for businesses and individuals that lease and occupy a vacant storefront in downtown Brockton.

Massachusetts Community Investment Tax Credit Program (CITC)

Aimed at improving economic opportunities in low- to moderate-income households, the Massachusetts CITC program incentivizes partnership between local residents, stakeholders, community development corporations (CDCs), nonprofits, and public and private entities through community investment plans, and community development programs and activities.

Massachusetts Historic Rehabilitation Tax Credits

For individuals and businesses that are rehabilitating historic structures certified by the Massachusetts Historical Commission. This program offers tax credits of up to 20% of the rehabilitation expenditures.

Massachusetts Life Science Credits

For certified life science companies, Brockton offers access to the state’s Life Sciences Investment Program and Life Sciences Tax Incentive Program. There are five different tax credits that qualified life sciences companies can apply for, as well as other tax incentives.

Massachusetts Medical Device Tax Credit

Eligible individuals and businesses that purchase qualifying medical devices may be eligible for a tax credit equal to 100% of user fees paid by the medical device company to the U.S. Food and Drug Administration.

Massachusetts Investment Tax Credit (ITC)

Corporations located in Brockton whose operations consist of manufacturing, research and development, agriculture, or commercial fishing may qualify for the state’s Investment Tax Credit when they lease or purchase qualifying tangible property.

Businesses located in Brockton that are engaged in research purposes may qualify for the state’s Research Credit for qualified expenses, which may include employee wages, portions of contractor fees, and purchase of supplies.

Massachusetts Workforce Training Fund Programs (WTFP)

Brockton employers who are training current or newly hired full-time employees within the state may qualify for grants of up to $250,000 through the state Workforce Training Fund.

District Improvement Financing (DIF) and Tax Increment Financing (TIF)

A suite of economic tools that incentivize public/private partnerships for redevelopment of blighted property within Brockton, whether they are project-based and focused on developers (TIF) or targeted redevelopment districts (DIF). Both programs modify property taxes over time. Brockton has used these extensively in its Enterprise Block redevelopment.

Federal Government

There are four federal Opportunity Zones in Brockton, each of which is designed to maximize investment opportunities. Two are located downtown, at the former CSX site and in the Transit-Oriented Development (TOD) area; one is the Brockton Fairgrounds, the largest undeveloped site in the city; and one around Good Samaritan Hospital. Special federal tax benefits are available to qualifying developments in these zones.

Through this federal program, Brockton can help individual and corporate investors access credits against their federal income taxes for equity investments in Community Development Entities that are working in low-income communities to reinvigorate local economies.

Historic Preservation Tax Incentives

Certified historic structures identified through the National Park Service and state historic preservation officials are eligible for individual or business income tax credits of up to 20% of the cost of rehabilitation for income-producing uses.

Small businesses located in Brockton’s federally designated HUBZones are given preferential consideration for contracts within these historically underutilized areas. In addition to limiting competition for certain contracts, HUBZone-certified businesses receive a 10% price evaluation preference in open contract competitions.