ARPA FAQ

If you wish to see this page in a different language,

please select it at the top left of the screen.

FACT SHEET- PHASE I

CITY OF BROCKTON AMERICAN RESCUE PLAN ACT (ARPA) GRANT PROGRAM

A. Purpose

On March 11, 2021, the American Rescue Plan Act (ARPA) was signed into law by the President. Section 9901 of ARPA amended Title VI of the Social Security Act to add section 602, which established the Coronavirus State Fiscal Recovery Fund, and section 602, which establishes the Coronavirus Local Fiscal Recovery Fund (together the Fiscal Recovery Funds). The Fiscal Recovery Funds build on and expand support provided to these governments over the last year, including the Coronavirus Relief Fund (CRF).

B. Overview

The City of Brockton issues this Request for Proposal to invite eligible nonprofit agencies and faith-based organizations to apply for Coronavirus Local Fiscal Recovery funds to assist with the ongoing COVID-19 pandemic. Prospective applicants should carefully read all guidance carefully. Applicants are required to abide by all federal, state, and local laws and regulations as it relates to Fiscal Recovery Funds. This includes all eligible uses as defined by 31 CFR Part 35 and all applicable provisions of 2 CFR 200. The transfer of funds from the City of Brockton and respective subrecipient is governed by the Section 602(c)(3) and 603 (c)(3) of the American Rescue Plan Act (ARPA) as it relates to subrecipients. Similarly, faith-based organizations are afforded the same compliance regulations under 2 CFR 3474.15- Contracting with faith-based organizations and nondiscrimination.

1. Who is allowed to apply?

Brockton focused nonprofit organizations, or an organization that is exempt from Federal income taxation and that is described in section 501 (c)(3) of the Internal Revenue Code, and faith-based organizations. Under Phase I of the ARPA grant program businesses are not eligible. Also, organizations must have, or is working towards, an active Dun and Bradstreet (DUNS) number and System Award Management (SAM) registration in order to be eligible. (https://sam.gov/content/entity-registration)

The applicant is responsible as a subrecipient of federal funding under CFDA #21.027- City of Brockton American Rescue Plan Act (ARPA) Grant Program and must be listed in their respective Single Audit Act report. Subrecipients that expend more than $750,000 in federal funding are subject to the Single Audit Act. A risk assessment has been included and must be filled out as part of the application process.

2. How much can I apply for?

The City of Brockton has committed $2,000,000 in Fiscal Recovery for nonprofit agencies and faith-based organizations as part of the first phase of funding under the grant program. The maximum award these entities will be allocated under Phase I is $200,000. Upon award, 25% of the funding will be allocated to the respective organization; subsequent reporting will be required by the subrecipient on a quarterly basis, detailing project activities in order to receive the second disbursement (25%) (June 27th, 2022), third disbursement (25%) October 3rd, 2022 and final disbursement (25%) (December 12th, 2022) (see question 8 for more details).

3. What can I use the funding for and when is the application due?

An attached schedule has been provided with all important deadlines. We strongly recommend applicants focus on general operating funding needs that have been greatly impacted by the COVID-19 pandemic. Please be aware that ARPA funds cannot be used for new projects that are unrelated to effects of the COVID-19 pandemic. If your organization has begun to develop a proposal related to new projects or purchases unrelated to how your organization was impacted by COVID-19, please change the focus of your application to an eligible activity. Treasury guidance has also been provided to show all eligible uses under ARPA. Ineligible uses include the following:

- Deposit into pension funds– the statute provides that recipients may not use Fiscal Recovery Funds for deposit into any pension fund. More specifically, the interim final rule does not permit assistance to be used to make a payment into the pension system if:

- The payment reduces a liability incurred prior to the start of the COVID-19 public health emergency;

- The payment occurs outside the recipients regular timing for making such payments.

- Funds cannot be used to offset a reduction in net tax revenue.

- Other restrictions on use– payments from Fiscal Recovery Funds are subject to pre-existing limitations provided in other Federal statutes and regulations and may not be used as non-Federal for other Federal programs whose statute or regulations bar the use of Federal funds to meet matching requirements.

4. How do I submit my application?

A link to a portal will be provided on the City website with detailed instructions on how to sign in and access the application. The provided application checklist indicates the necessary attachments the applicant will be required to provide. Please fill out the budget template provided, and upload it to the appropriate section. All organizations must fill out a budget or they will not be eligible to receive funding. All required documents must be attached to your application. If you cannot provide a particular document, please upload a statement explaining your particular hardship or eligibility as it relates to the specific form.

5. I am having difficulty with the provided forms, what should I do?

Please remember to download all instructions and attachments on the APRA website. All forms have been translated into multiple languages for your assistance.

Additionally, all attachments and appendices must be uploaded to the application website under the applicable section. The ARPA application checklist provides a comprehensive list of what you need. This includes:

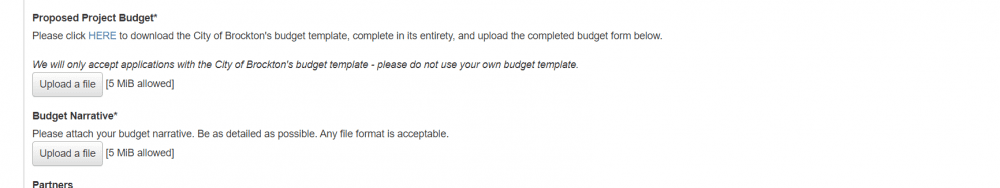

- ) Budget Template- A budget template has been provided for you to download in the application. Please fill out this template only, and upload to the appropriate section. All organizations must fill out a budget or they will not be eligible to receive funding. We must have a detailed breakdown of all expenditures as it relates to your proposal. Upon award you will be responsible for each expenditure and must provide a quarterly report regarding progress, in addition to backup documentation such as invoices.

- ) Budget Narrative- Accompanying your budget must be a budget narrative explaining each expense in as much detail as possible. You can use any format for this narrative, such as a Word Document.

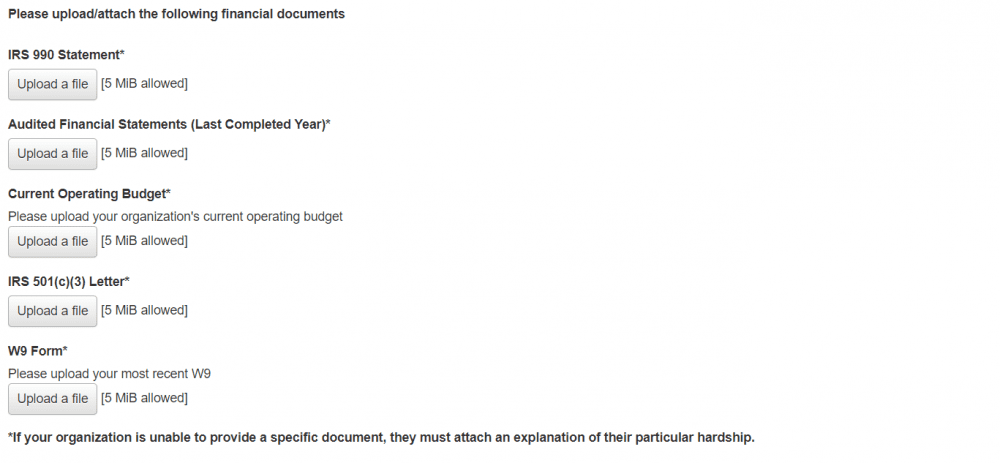

- ) IRS 990 Statement

- ) Audited Financial Statements

- ) Current Operating Budget

- ) IRS 501 c 3 letter

- ) W-9 Form

**The documents must be attached to your application. If you cannot provide a particular document, please upload a statement explaining why.

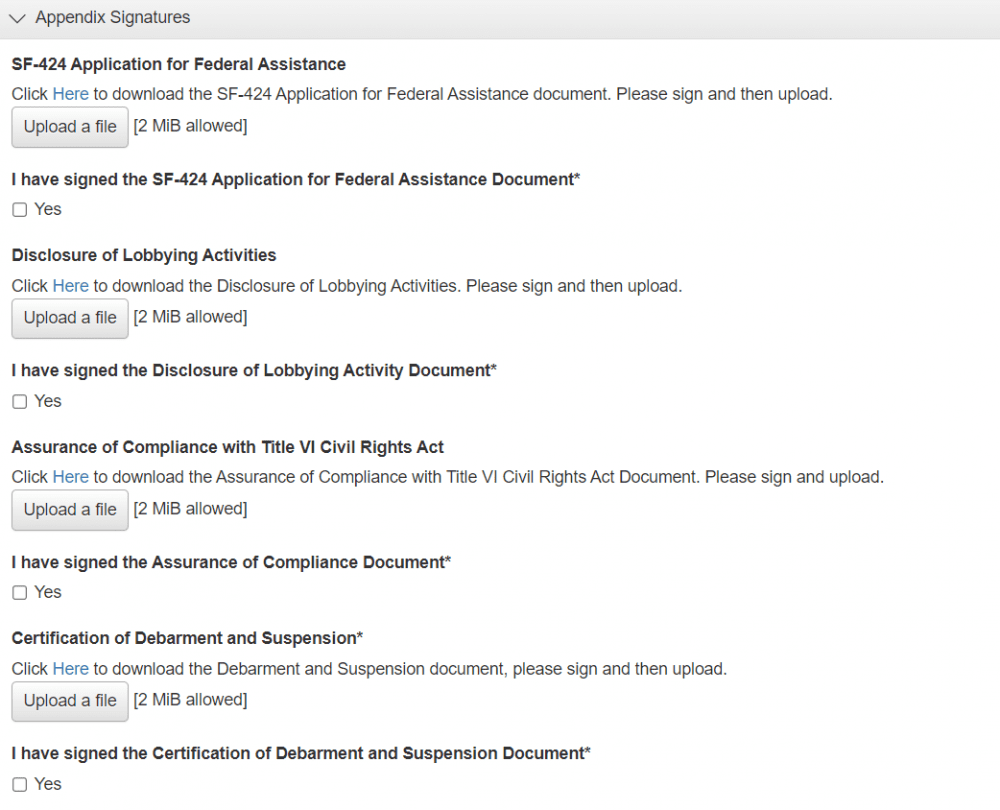

- ) SF-424 Application for Federal Assistance- The ARPA grant program is the same as a federal grant application in which the applicant is required to file a federal assistance form. Instructions on how to fill the form is on the website. Sections that are highlighted and bolded must be filled out in particular. Do the best you can with filling this out.

- ) Disclosure of Lobbying Activities- this form is required on federal applications and ensures your organization has not engaged in lobbying activities.

- ) Certification of Debarment and Suspension- this form is to be filled to ensure your organization has not been convicted of fraud or suspended for any reason

- ) Title VI Civil Rights Act Compliance- this form is required by the Treasury Department to ensure an organization commits to fair practices under the Civil Rights Act.

**The documents are contained in your application that must be filled out and uploaded to the appropriate section.

6. When will my application be reviewed and what is the review process?

A review committee consisting of a member of the Finance Department, Mayor’s Office, and a community liaison, will review and score applications based on the evaluation rubric contained in the application portal.

7. How do I know if I am awarded?

The nonprofit agency and faith-based organization will receive an award letter signed by the Mayor and Chief Financial Officer. Additionally, a packet of award documentation will be provided including a grant agreement to be reviewed and signed by the respective nonprofit and faith-based organization. All state, federal, and local procurement laws will apply.

8. How long is the grant period?

The performance period for Phase I will commence February 21st, 2022- January 29th 2023. On or before January 29th 2023, all subrecipients will be required to closeout any final expenses and provide all outstanding invoices, receipts, and grant reports to the City’s grant contacts.

9. Are there any reporting requirements?

Yes. The subrecipient will be responsible for providing a detailed quarterly expenditure report (provided upon award) outlining expenses incurred in addition to current objectives/goals, project activities, and principal accomplishments based on the provided timeline in the application. During the reporting period subrecipients must provide all supporting documentation (invoices) as it relates to expenses incurred.

10. What happens if I need to make a change to my budget and/or scope of services?

Quarterly reporting periods will provide an opportunity for subrecipients to amend the budget as necessary, while maintaining the outlined eligibility. If a budget adjustment is needed soon an amendment letter must be submitted to the City of Brockton’s grant coordinator. Similarly, changes in the scope of services must be amended during the quarterly report period, or a written letter must be filed to the grant coordinators.

11. What happens if I do not comply with the requirements?

Subrecipients that do not comply with federal, state, and local guidelines and reporting requirements set forth in this agreement, may be subject to a termination of contract and required to return the funds to the City of Brockton. Additionally, any remaining funds that are not expended are subject to be returned to the City of Brockton. Failure to comply will result in ineligibility of the subrecipient for future grant funding under the City of Brockton American Rescue Plan Act (ARPA) Grant Program.

12. Who do I reach out to if I have any questions?

Any questions you may have before, during, or after you submit your application regarding the proper use of funds, narrative development, and filling out forms, please reach out Paul, Jazmine, or Brady:

Paul Umano, Financial Analyst

City of Brockton

[email protected]

508-897-6815

Jazmine Bradsher, Director of Social Services

City of Brockton

[email protected]

508-580-7123

Brady Winsten, Policy & Intergovernmental Affairs Associate

City of Brockton

[email protected]

508-580-7123